What a difference a year makes! The summer of 2022 was a golden age for U.S. E&Ps that embraced a dramatic shift in their business model from prioritizing growth to a focus on maximizing cash flows and emphasizing shareholder returns. Oil prices over $90/bbl and gas prices hovering about $7/MMBtu filled their coffers and funded lavish increases in share repurchases and dividends. But those golden days quickly faded as oil prices retreated and gas prices plunged 66% to just above $2/MMBtu. In today’s RBN blog, we explain how E&Ps are scrambling to sustain shareholder return programs in the face of shrinking cash flow.

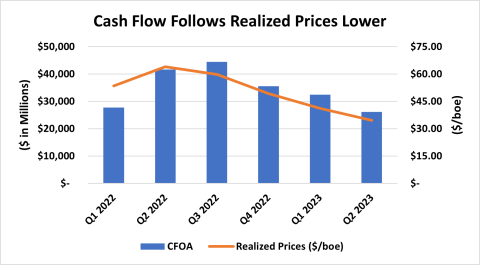

In our blog Two Shots of Happy we recapped a near-idyllic Q2 2022 as cash flows for the 41 U.S. E&P companies we follow surged 22% from the preceding quarter to $43.4 billion on average prices of $108/bbl for oil and $7.47/MMBtu for gas. Cash flow from operating activities (CFOA) topped out at $46.5 billion in Q3 2022 as share repurchases more than doubled to $9.7 billion from $4 billion in Q1 2022 and dividends rose 62% to $8.7 billion. But as shown in Figure 1, the average realized price (orange line) peaked in Q2 2022 and fell to $34.57 per barrel of oil equivalent (boe) by Q2 2023, 46% lower than a year earlier. Cash flows (blue bars) followed suit, reaching a two-year low of $26.2 billion.

Figure 1. Cash Flow and Realized Prices, Q1 2022-Q2 2023. Source: Oil & Gas Financial Analytics, LLC

Compounding the lower commodity prices is the impact of inflation on the cost of oilfield goods and services. Producers largely held the line on capital investment in 2022, budgeting maintenance-level spending that increased modestly from $14.4 billion in Q2 2022 to $15.8 billion in Q4 2022. However, higher costs and the need to replace inventories of drilled but uncompleted wells (DUCs) have driven capex to $18.5 billion in Q1 2023 and $20 billion in Q2 2023.

Join Backstage Pass to Read Full Article