Move over old dog ‘cause a new dog’s moving in. That dog would be crude oil from North America producers -- mostly light-sweet crude from the Bakken – moving by rail to Albany and on to other points east. Not only is it a good market for Bakken oil, it might just be the ticket out of financial meltdown for East Coast refiners.

On Friday I was a speaker at the 2012 U.S. Energy Services Annual Conference in Phoenix. The crowd was a very diverse mix of energy users – across the hydrocarbons spectrum – power, gas, petroleum products, ethanol, etc. These folks are grappling with the changes in energy markets in their daily operations, and among many issues wanted to understand the implications of changing crude costs, refinery capacity and crude-by-rail.

|

Note: Check out contributor Kyle Cooper’s natural gas markets posting this morning on the Markets page. Kyle’s most recent weekly will be there each Monday morning. Today’s is Natural gas at $2.50 significant for coal; small storage build. |

I’ve been using a picture of one of the Bakken loop track facilities in my presentations to help illustrate the magnitude of these terminals. It turned out that one of the developers of this terminal was in the audience. The picture of that terminal follows.

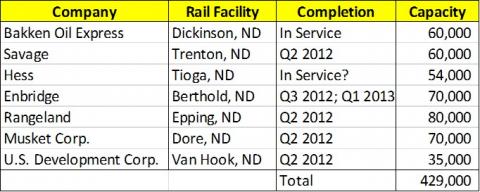

Obviously this is not your father’s choo choo. Some of these things can accommodate two or more unit trains of 100 cars each. A typical rail car holds 30,000 gallons, or 714 barrels. So 100 car unit trains can hold 71,400 barrels. These facilities are popping up all over. The table below from Bentek’s PADD 4 Rockies Oil Observer shows seven new facilities that are already in service or will be in service in the very near future, adding 429,000 b/d by the first quarter of next year. Bakken Oil Express in Dickinson is in service. Coming in Q2 are Savage at Trenton, Rangeland at Epping, Musket at Dore and U.S. Development at van Hook. Hess at Tioga is in service with 25,000 Mb/d today and will be at 54,000 b/d by year end. Enbridge at Berthold will be at 10,000 b/d by Q3 2012 and 70,000 by Q1 2013.

These facilities are on top of seven existing rail terminals in North Dakota, some of which have been around for years. These include Stampede, Donnybrook, Ross, Stanley – EOG, Minot, Dore, New town and Beulah.

Rail is making inroads in other crude plays. U.S. Development (USD) has an Eagle Ford terminal going in just south of San Antonio. It is scheduled to be completed in July. USD also has the Niobrara Crude Terminal in Colorado. Rail terminals from South Texas to Ohio are seeing record volumes of crude tank car shipments.

Don’t take those capacity numbers at face value. Like so much of the rapidly expanding hydrocarbons infrastructure these days, there are constraints inbound barrels and on take-away capacity. These constraints can come in several forms, including:

Join Backstage Pass to Read Full Article