Last week WTI crude prices fell 8% or $7.63 in four days. There was a small uptick on Monday (+$0.75/bbl), but it did almost nothing to erase the huge 20% decline in crude prices so far this year. WTI closed on Monday (June 4, 2012) at $83.98/Bbl. Brent prices dropped below $100/Bbl on Friday for the first time since October 2011 to close at $98.70/Bbl. (The London market was closed Monday for a holiday). On Friday of last week, world crude markets were reacting to Saudi Arabian crude exports hitting their highest levels for years. As mentioned in Thursday’s blog ( A Drop in the Ocean? ) falling crude prices are also being impacted by wider economic factors like the banking crisis, US jobs weakness and shaky Chinese manufacturing. With all of these factors hitting the crude market, how are US crude stocks factoring into the equation? That’s what we’ll look at in today’s blog

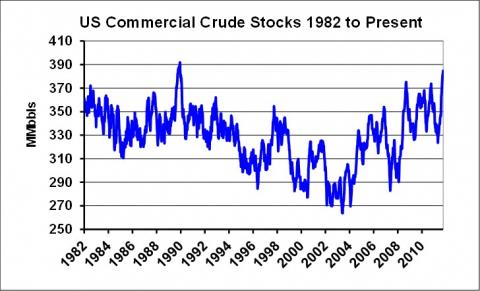

According to the EIA petroleum status report released last Thursday for the week ending May 25, 2012, US stocks of commercial crude oil [1] are close to their all time high at 384.7 MMBbl. (see chart below). Stocks have only been higher once since the EIA started keeping records and that was back in July 1990. Right now we are 2 percent below the record. Crude oil stocks are sky high.

Keeping oil in storage is not free. It costs big money. There are two primary incentives to put crude in storage – financial (to make money because you can lock in the differential between today’s price and a price in the future) and expediency (because you believe the price the market offers today is too low and that future prices will be higher). Let’s walk through these two incentives in turn, see which one is causing the stockpile and what the implications are for falling prices.

The first and most obvious storage incentive is financial. This incentive occurs when forward or future oil prices are higher than prices today. There’s a name for this market situation – contango. (When crude futures are lower than today’s price, it’s called backwardation.) When contango occurs, traders take advantage by buying crude today, placing it in storage and selling higher priced futures contracts to lock in the storage premium. If this incentive were working now then we could surmise that the record crude stocks are being caused by a wide contango market.

To evaluate contango, we compared crude futures spreads with crude stocks. First, using the benchmark WTI futures contract we calculated the spread between prices three months out and prices nearby. Then we compared the spread numbers to crude stocks. However, instead of looking at total stocks we looked at crude oil days supply. Days’ supply is crude stocks divided by refinery consumption. The days supply number tells us how many days the stocks would last at the current rate of consumption. Chart 2 below shows crude spread and days supply since January 2011.

Looking at the chart we see that although the crude spread (blue line) has been in contango (above $0/Bbl) for most of the last year, it has been lukewarm at best (around $1/Bbl) since about April of 2011. Back in February of 2011, contango ballooned out to $6/Bbl creating a clear market opportunity to buy and store. Days supply (the red line) increased sharply immediately after that event as traders took advantage of the situation to buy and store crude. However, nothing in the more recent crude spread data shows any obvious financial incentive to store crude. What is significant is that days supply increased rapidly since the beginning of 2012 while crude spread contango stayed relatively flat. This means that the incentive behind today’s near record crude stockpile is not a financial storage premium.

Since the current incentive to store crude is not a financial storage premium, then it can only be expediency. The expediency storage incentive occurs when holders of crude in storage are unwilling to sell at today’s prices or what they believe would happen to today’s prices if large volumes coming out of storage flood the market. In effect, they are wagering that waiting for better market conditions will provide higher prices down the road, even though there is little or no current storage premium in the forward curve.

This is symptomatic of an oversupplied market. If storage holders sell crude into an oversupplied market then prices will simply fall – potentially crashing. It is better to hold on and wait for an improvement in demand than to risk a fire sale. It is however, a very painful situation to be in. Holders of crude in storage when prices are falling have to pay fees for storage while they watch the value of their crude go down. When prices fall 8 % in a week like last week, that’s a hard pill to swallow.

As we have seen in past blogs, the near record US crude stockpile is being sustained by rising domestic production and rising imports from Canada. (See Independence Day – US & Canada Self Sufficient in 5 Years?) Crude from Western Canada and the Bakkan shales is backing up at the landlocked, capacity constrained Midcontinent Cushing storage hub.

To fix the situation, all we need is new pipeline capacity from the Midcontinent region into the Gulf Coast market. But that is going to take more time. Those flows are not going to start happening in any material way until next year when Seaway is expanded to 400 Mb/d or the year after when the Keystone Gulf extension adds another 800 Mb/d of capacity between Cushing and the Gulf.

Until then, crude storage holders will have to hold tight and pray that the international market fundamentals causing last week’s price free fall are reversed by improved sentiment or perhaps a good old fashioned OPEC production cut.

"Crude Oil Blues" is a 1974 song from Jerry Reed off the album "A Good Woman's Love"

[1] EIA reports total crude stocks each week as well as stocks in the government controlled strategic petroleum reserve (SPR). Since the SPR is only accessed infrequently by the government, we will ignore the SPR and just look at the published commercial crude stocks.

Each business day RBN Energy posts a Blog or Markets entry covering some aspect of energy market behavior. Receive the morning RBN Energy email by simply providing your email address – click here. |