The prospect of a massive buildout of data centers across the U.S. has utilities preparing for a surge in power demand. And while access to an uninterrupted power supply is a critical factor for companies deciding where to build a data center, it’s not the only variable — power prices and proximity to customers also play a major role. In today’s RBN blog, we’ll look at where data centers are deployed across the U.S., the major factors that determine where a facility gets built, and how the sudden expansion is playing out in the major U.S. technology hubs.

As we wrote in Storm Front, a data center is a facility housing many networked computers that work together to process, store and share data. Most major tech companies — such as Amazon, Google and Meta — rely heavily upon data centers as a central component in delivering online services. Most relevant to our discussion today, data centers are energy-intensive, consuming anywhere from 10 to 50 times the energy per floor space of a typical commercial office building, with electrical demand at larger facilities ranging from 100 to 300 megawatts (MW), or enough to power tens of thousands of homes.

This substantial growth in data center capacity, which we detailed in Smarter Than You, has been driven largely by the increasing demand for artificial intelligence (AI) and what are generally classified as AI-powered tasks, such as speech recognition, image recognition, predictive analytics, personalized diagnostics/treatments, logistics/mapping applications, fraud detection, and of course, generative AI. The rapid rise in interest in generative AI is particularly noteworthy, catalyzed by the sudden success of ChatGPT (which launched in November 2022) and a few other AI chatbots that have popped up riding that wave, including Claude, Copilot, Jasper and perplexity.ai.

And as we noted recently in We’ll Be Together, the growing number of data centers coming online across the U.S. is spurring utilities to ramp up their plans to add new sources of power generation but also complicating their efforts to decarbonize. One of the hottest topics in energy today is how plans to restart shuttered nuclear plants and initiatives by U.S. economic titans Google and Amazon to build new advanced reactors to help power their data centers could help accomplish both goals.

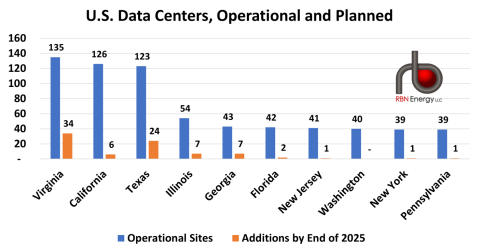

Let’s look next at how many data centers are already online and how many are expected to be in operation by the end of 2025. According to our friends at IIR Energy, a global leader in market research, there are 1,066 hyperscale data centers operational in the U.S., with another 122 expected to be online by the end of 2025. That total includes cloud servers, web hosting servers, AI-focused centers, and cryptocurrency/bitcoin mines. (Hyperscale facilities are generally considered to have at least 5,000 servers and be at least 10,000 square feet in size. The biggest data centers, however, can be more than 1 million square feet across multiple buildings.) Virginia, California and Texas lead the nation in existing sites (blue bars in Figure 1 below), while Virginia and Texas are far and away the leaders in expected additions (orange bars).

Figure 1. U.S. Data Centers, Operational and Planned. Source: IIR Energy

Join Backstage Pass to Read Full Article