Before data centers were the hot topic everywhere, Virginia was already rolling out the red carpet and it seemed that tech firms were constructing facilities as fast as humanly possible, drawn by the state’s robust fiber-optic network and low power prices. But while other states are racing to catch up, Virginia may be hitting the brakes. In today’s RBN blog, we’ll look at what makes Virginia so “sweet” for data center developers, their impact on the state, and efforts by some to slow progress.

This is our latest piece in a series looking at how some of the most popular states for data centers are faring. As we discussed in God Blessed Texas, the Lone Star State, with more than 350 data centers, is one of the nation’s leaders, with only Virginia edging it out in both the number of data centers and associated power demand. Texas’ neighbor to the east, Louisiana, was initially slow in attracting developers but now has two hyperscale projects being built. As we noted in Louisiana Saturday Night, state lawmakers changed laws to establish incentives for data centers and also used federal grant money to ramp up its fiber-optic network.

That brings us to Virginia, which is at the opposite end of the extreme from Louisiana. The state was the pioneer for data centers and has been home to them since the 1990s — long before most people even knew what a data center was. Dominion Energy, the state’s largest utility, reported in its February earnings call that its contracted data center capacity (i.e., future power commitments, not current load) in Virginia surged from about 21 gigawatts (GW) in July 2024 to nearly 40 GW by December 2024, reflecting an 88% increase over roughly six months. Dominion said in February that its area within the PJM Interconnection market would see peak electricity load climb to 41.5 GW by 2034. (Dominion set a single-day peakload record of 24.6 GW in January.) To put that into perspective, the entire country of Italy consumed about 43 GW of power in 2023; the UK consumed about 34 GW the same year.

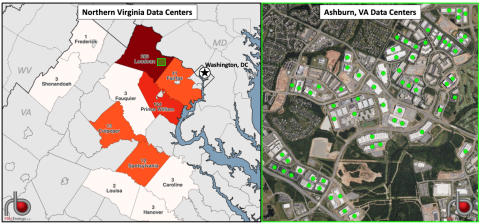

Virginia is home to more than 550 data centers (some estimates put the total well over 600), with at least 70 more in the planning stages. The northern part of the state (just to the west of Washington, DC) is a massive hub for data centers, especially Loudoun County (left side of Figure 1 below), which has nearly 300 data centers and accounts for more than 6 GW of power demand. The corridor — known as “Data Center Alley” — stretches across Loudoun, Fairfax and Prince William counties and hosts the largest concentrations of data centers in the world. Loudoun County alone has more than 49 million square feet of data center space, with many sites clustered close together (green dots on right side of Figure 1) and many more under development. Loudoun County boasts that it has not had a single day without data center construction in more than 14 years.

Figure 1. Northern Virginia Data Centers. Sources: Google Maps, DataCenterMap.Com

Note: Data centers indicated by green dots on right side.

Join Backstage Pass to Read Full Article