The Federal Reserve cut interest rates three times last year, brightening the prospects for continued economic growth and increases in energy demand, and additional rate cuts could be coming in 2025. But what do lower borrowing costs really mean for E&Ps, midstream companies, refiners and others in the energy industry? In today’s RBN blog, we will examine the impact of lower interest rates on energy companies and whether they might affect plans to boost output and build new infrastructure.

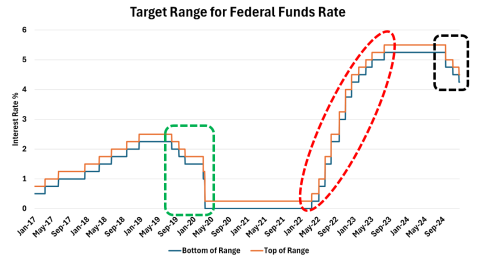

Before we dive in, let’s take a minute to discuss interest rates and why they shift over time. The U.S. central bank, or Federal Reserve (commonly known as the Fed), has a dual mandate: maximize employment and keep inflation low (ideally at 2% or less). The Fed sets what’s known as the Federal Funds Rate (FFR), a key short-term interest rate — typically a range of 0.25% or 25 basis points — primarily used by banks when lending to one another. (The orange and blue lines in Figure 1 below indicate the top and bottom of the ranges, respectively, beginning in 2017.) The FFR influences the so-called prime lending rate, the percentage that commercial banks charge their most creditworthy customers. Loans to the energy sector can be tied to both the FFR and the prime rate. And since many oil and gas projects rely on external funding — whether from banks or other financial institutions — any move by the Fed is closely watched.

Figure 1. Target Range for Federal Funds Rate. Source: Federal Reserve

The Fed adjusts the FFR based on a wide range of economic indicators. It decreased the rate as the pandemic hit to help buoy the economy (dashed green box), then increased the rate several times in 2022 and 2023 (dashed red oval) to help bring down inflation without sending the economy into a recession — the goal being a so-called “soft landing.” The 50-basis-point cut in the FFR to 4.75%-5% in September, followed by a reduction to 4.5%-4.75% in November and 4.25%-4.5% in December (dashed black box), basically informed the market that borrowing costs across the business community were finally beginning to decrease.

Join Backstage Pass to Read Full Article