There’s a lot going on in North American crude oil markets these days. Exports are running strong. Midland WTI is now deliverable into Brent (but only if it meets specs). Pipelines from the Permian to Corpus Christi are maxed out, pushing incremental production to Houston. The price differential between WTI at Midland and Houston is nearing zero. And the value of heavy Western Canadian Select (WCS) delivered to the U.S. continues to bounce all over the place. Are these unrelated, random events in the quirky U.S. physical crude market, or are they logical developments linked by the economics of refinery preferences, quality shifts, export demand, and logistics? As you might expect, we think it’s the latter. Believe it or not, crude markets sometimes do behave rationally — and, from time to time, even predictably. That’s what we explore in today’s RBN blog.

Beyond the Blogosphere! Join RBN’s Rusty Braziel and Marty King and Link Data Services’ Scott Nelson for our Let’s Get Physical North America crude markets webcast on Tuesday, August 29, at 2:30 p.m. Central Time. To register, click here.

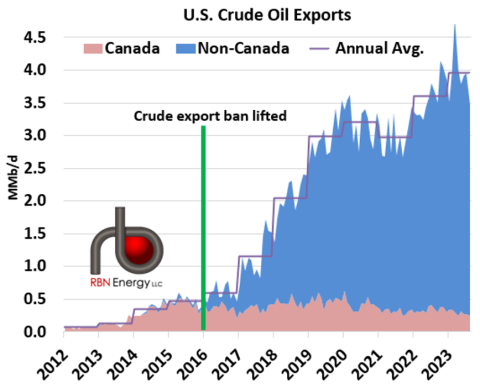

It will come as no surprise to anyone familiar with the RBN blogosphere that one of the primary market drivers of crude oil in North America for the past seven years has been exports. As shown in Figure 1, exports are up from a round-off error before 2015, when the export ban to non-Canadian countries was lifted, to nearly 4 MMb/d so far this year. Besides COVID-impacted 2020-21, the rise has been steep and steady. Roughly 9% of those export barrels are still going to Canada (pink layer in graph), with the rest going to overseas markets (blue layer). With U.S. production up to 12.7 MMb/d as of the most recent EIA stats, that puts exports at 31% of produced barrels. Of course, the U.S. still imports somewhere in the 6-7 MMb/d range, but all of that is medium-to-heavy, sour (higher-sulfur) crude that the U.S.’s complex refineries in PADD 2 (Midwest) and PADD 3 (Gulf Coast) can break down into valuable refined products, and 60% is coming from Canada, while U.S. exports are almost exclusively light, sweet (low-sulfur) shale crudes that are generally a much better fit for overseas refineries than those in the U.S.

Figure 1. U.S. Crude Oil Exports. Source: EIA

Join Backstage Pass to Read Full Article