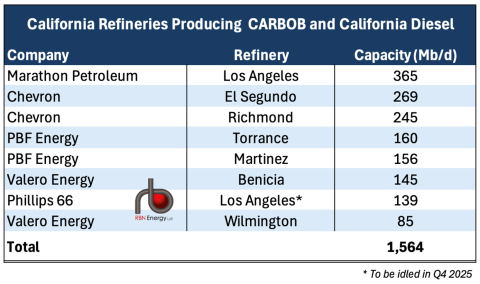

Weak refining margins, rising regulatory compliance costs, softening demand for gasoline and the push for lower-carbon alternatives like batteries and renewable diesel have each contributed to a steady decline in California’s refining capacity the past few years. Now, Phillips 66’s plan to idle its 139-Mb/d Los Angeles Refinery in Q4 2025 will leave the Golden State with only seven conventional refineries producing gasoline, diesel and jet fuel — a couple of dozen fewer than it had 40 years ago. In today’s RBN blog, we’ll put P66’s recent announcement in context and discuss the likelihood of additional refinery closures.

California’s refining sector — and the state’s ambitious efforts to decarbonize its economy — has been a frequent topic in the RBN blogosphere. Most recently, in I Asked For Water (She Brought Me Gasoline), we discussed the many ways that California is a refining/refined-products market unto itself, with special circumstances and a definite tilt against fossil fuels. Consider this:

- Three-quarters of the crude oil refined there is shipped in — 14% from Alaska and 61% from foreign sources (mostly Iraq, Saudi Arabia, Brazil, Ecuador, and, since the startup of TMX, Canada) — with only 25% coming from in-state wells. This is a major disadvantage vs. refiners in most of the rest of the U.S. (with the exception of the East Coast), which have benefited significantly from the boom in domestic production, and is a major shift from a few decades ago when California crude production was more than triple current levels.

- Service stations can only sell the state’s unique gasoline blend, known as California Reformulated Gasoline Blendstock for Oxygenate Blending (CARBOB), which meets the state’s tougher clean-air requirements.

- There are no refined-products pipelines that connect the state’s northern and southern population centers, and no pipelines that deliver gasoline into California from other states.

- The state’s Low Carbon Fuel Standard (LCFS), which incentivizes the production of renewable diesel, biodiesel and other lower-carbon transportation fuels, has been trimming demand for conventional diesel, meaning the large majority of diesel produced by California refineries must be exported, mostly to the west coast of Mexico and Latin America.

Add to that the fact that California has more electric vehicles on the road today (about 1.25 million at last count, according to the U.S. Department of Energy) than the next eight states combined and a law requiring that all new cars and light trucks sold in the state in 2035 and beyond be zero-emission vehicles (ZEVs) such as battery-electric and hydrogen fuel cell vehicles. And, while it was not a factor in P66’s decision to shut down its Los Angeles Refinery, there’s California’s Assembly Bill X1-2 (AB X1-2, aka the California Gas Price Gouging and Transparency Law), which, among other things, authorizes the California Energy Commission (CEC) to set a maximum gross gasoline margin (and a penalty for refiners that exceed it) and establish a requirement that refineries stockpile specified volumes of gasoline to minimize the risk of fuel shortages.

Figure 1. California Refineries Producing CARBOB and California Diesel. Source: EIA

Join Backstage Pass to Read Full Article