The largest crude oil pipeline exiting the Permian Basin by volume — Wink to Webster (W2W) — is planned to be offline for maintenance for the first 10 days of June. This is inclusive of Enterprise’s Midland-to-ECHO III (ME III), which reflects the company’s 29% undivided joint interest in W2W. Although the outage has not been publicly confirmed, it’s our understanding that 1.5 MMb/d of capacity will be offline to reroute a small section of pipeline. In today’s RBN blog, we’ll examine how the planned maintenance will impact Permian Basin oil takeaway capacity and what it may mean for Midland WTI pricing.

As we detailed in Houston Bound, the W2W pipeline is a huge pipe operated by ExxonMobil with five other companies holding an ownership interest (Plains All American, MPLX/Marathon, Delek US, Lotus Midstream, and Rattler Midstream/Diamondback). Together with ME III, it moves 1.5 MMb/d and has doubled capacity from the Permian to Houston up to 3 MMb/d. W2W began commercial service at the end of 2020, transporting oil from Midland — the heart of the Permian Basin — to Webster, TX just south of Houston and from Webster to Baytown along the Houston Ship Channel.

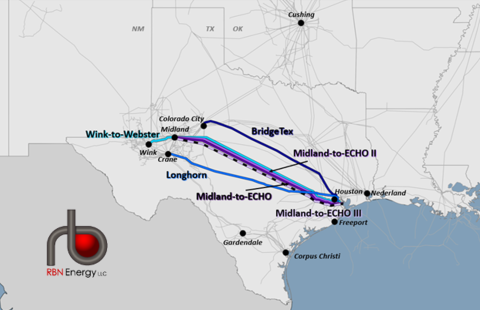

It is important to note that this is not one of the underutilized oil pipelines. According to our Crude Oil Permian Report, where we track Texas Railroad Commission (RRC) data, W2W (teal line in Figure 1 below), including ME III (450 Mb/d; pink-and-black dashed line), reached nearly full utilization in January of this year. In Q4 2023, RRC data indicated flows began on a new section of pipeline linking the crude oil hub at Wink (which is farther west in the Delaware sub-region of the Permian) to the Midland origin, adding to the significance of the Wink hub (more on Wink in an upcoming blog). As of January, approximately 150 Mb/d was flowing on W2W from Wink.

Figure 1. Permian Basin Oil Pipelines to Houston. Source: RBN

Join Backstage Pass to Read Full Article