Soaring demand for around-the-clock electricity, tied to the development of large-scale data centers, has sparked a renewed interest in carbon-free nuclear power. Given that conventional nuclear plants can be very challenging to site and permit, there’s been a lot of talk about installing small modular reactors (SMRs) at the sites of coal-fired power plants that have been taken offline for environmental and economic reasons but still have critical connections to the power grid and other infrastructure. In today’s RBN blog, we examine the potential to replace coal with nuclear and preview our latest Drill Down Report on the growing enthusiasm for nuclear power in the U.S.

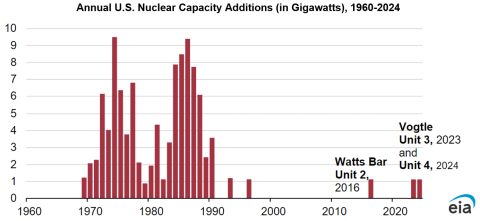

For 70-plus years, the U.S. has had an ever-shifting love/hate relationship with nuclear power. Way back in 1954, Lewis Strauss, chairman of the Atomic Energy Commission, predicted that nuclear power would prove to be “too cheap to meter.” From then to the 1980s, there was a nuclear construction spree — by 1990, nuclear reactors supplied nearly one-fifth of the demand for electricity in the U.S. However, the partial meltdown at Three Mile Island Unit 2 in 1979 (followed by the Chernobyl disaster in Ukraine in 1986) deflated public support for nuclear power, and the pace of development in the U.S. slowed to a crawl (see Figure 1 below). As we note in Section 2 of our new report, the rising cost of nuclear projects didn’t help: The most recent U.S. nuclear additions — two new, 1,215-megawatt (MW) units at Plant Vogtle in Georgia — cost nearly $37 billion, or 2.6X their initial $14 billion estimate, and were completed years behind schedule. (Section 4 focuses on the lessons to be learned from Vogtle.)

Figure 1. Annual U.S. Nuclear Capacity Additions (in Gigawatts), 1960-2024. Source: EIA

At least a few primary drivers behind this new interest in nukes exist. One is the push to develop low- or no-carbon sources of electricity, particularly those that (unlike wind and solar) can be counted on 24/7. That has led to efforts to bring shuttered reactors back to life, including the 800-MW Palisades nuclear plant in Michigan. Another driver is the predicted ramp-up in power demand from the large-scale data centers planned to support artificial intelligence (AI). Estimates suggest an additional 10 Bcf/d of natural gas will be needed for power generation by 2030, driven primarily by data center growth and coal plant retirements, potentially reaching 18 Bcf/d if data center construction accelerates rapidly.

Join Backstage Pass to Read Full Article