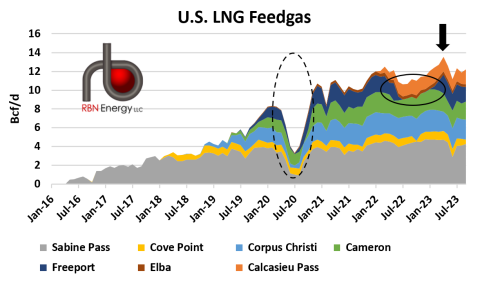

LNG feedgas demand has averaged a record of about 12 Bcf/d this summer and fall. While that may sound like an impressive number (and it is), it could increase significantly — even without new capacity additions — over the next few months as seasonal demand rises and maintenance activity slows. And that’s just for starters. Next year, the first of several planned LNG export terminals and expansions of existing ones will start commissioning, and by the end of this decade feedgas demand may well double. In today’s RBN blog, we look at how current LNG feedgas demand stacks up compared to past years, the factors driving current demand, and the potential for additional upside.

In the early years of U.S. LNG exports — from when Sabine Pass began operations in early 2016 through COVID’s arrival in early 2020 — feedgas demand for LNG climbed steadily. Nearly every month, a new feedgas record was set as an expanding fleet of LNG terminals came online. The pandemic stopped that growth in its tracks: feedgas demand peaked in February 2020 at 8.32 Bcf/d and then plummeted, averaging just 3.24 Bcf/d in July 2020 as more U.S. cargoes were canceled than exported (dashed black oval in Figure 1).

Figure 1. U.S. LNG Feedgas Demand by Terminal. Source: RBN LNG Voyager

Join Backstage Pass to Read Full Article