A couple of weeks back (February 23) Goldman Sachs advised their clients to buy WTI futures for September delivery on speculation of a rise in value after the Seaway Pipeline between the US Gulf and Cushing, Oklahoma is reversed in June. Bloomberg/Business Week quoted the report as saying “Investors should take a long position on West Texas Intermediate oil as the U.S. benchmark grade will rise and the discount to London-traded Brent will narrow. It seemed like this might be an ace that I could keep…. [Posted by contributor Sandy Fielden]

See the lowdown on this trading tip here:

Let’s take a look at the logic behind GS’s advice to short the Brent-WTI differential, and what risks are inherent in this trade. First some history.

For decades, through the 1980s and 90s, the relationship between WTI at Cushing, OK and that other U.S. crude benchmark – Light Louisiana Sweet (LLS) at St. James, Louisiana tracked within +/- $1.00/Bbl most of the time. That lasted until about 2004 when the differential started to become quite volatile. During the 2005-09 period, WTI traded at a significant positive differential to LLS, resulting from declines in crude oil supply into Cushing and markets served by the Cushing hub. The differential also became much more volatile, resulting in some calls for WTI to be replaced as the key U.S. crude oil benchmark price. That volatility translates directly to volatility in the WTI-Brent relationship

Brent is the key crude oil benchmark in world markets. It actually represents a basket of North Sea crudes in a set of formulas too complex to explain here. As of 2009, about 65% of the world’s crude was priced relative to Brent. (It is less so now.) Brent was historically priced under LLS, reflecting the cost of delivering Brent crude to U.S. coastal refineries. Consequently, WTI traded above LLS and LLS traded above Brent.

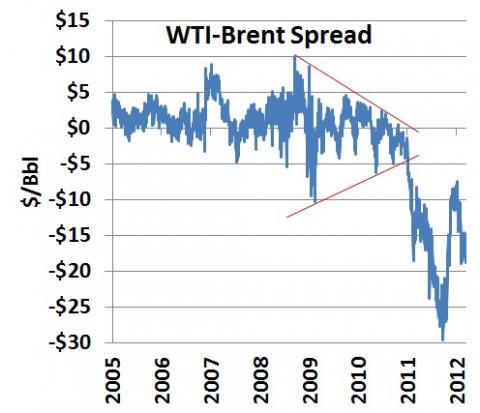

The graph below shows the WTI-Brent differential from the direction that it has historically been show -- WTI less Brent.

WTI was consistently a few dollars higher than Brent until the chaos of 2009. Then the differential jumped $5-$10/bbl to either side of zero until 2011. That is when the impact of tight oil (shale oil), mostly from the Bakken really started to be felt. As RBN regular readers will be well aware, the growth in U.S. crude oil production from the Bakken and other midcontinent plays has resulted in an oversupply situation at Cushing. The glut is causing crude prices at Cushing (based on differentials to WTI) to suffer relative to the Gulf Coast (where prices are closer to the international market benchmark –Brent). Put another way, Midwest refineries are oversupplied and bidding down prices, Gulf Coast refineries are undersupplied and bidding up prices. In the first thirty days of 2011, the differential blew out to $18/bbl, eventually hitting $29.61 on September 21st. There was simply not enough cost effective capacity to get crude oil stored at Cushing to refineries along the Gulf Coast. It looked like that situation would prevail for some time, until new pipelines were built.

But then on November 16th at 10:45am, Enbridge and Enterprise announced that they had agreed to purchase ConocoPhillips interest in the Seaway Pipeline that had been flowing south-to-north and reverse it into a north-south conduit. WTI prices jumped immediately, and the differential fell to less than $10/Bbl – without anything happening except for a press release which said the first phase would be operational by April. Hmmm.

Then on January 20, Enterprise announced that it would be June before the pipeline would be operational. Over the next two weeks the differential widened back out to $ 16/bbl. That’s where it was when the GS piece hit the streets. The differential is now closer to $18/bbl. Hmmm.

At this point, what is supposed to happen? Sometime June (or before), the Seaway pipeline that was pumping 90,000 b/day from the Gulf to Cushing will be reversed to initially pump 150,000 b/day from Cushing to the Gulf. This provides a net 240,000 b/day relief to both the oversupply in the Midwest and the undersupply in the Gulf. Presumably, this will reduce the downward pressure on WTI prices leading to a rise in WTI futures against Brent. So the differential would come back in, and the advice from GS would result in a profitable trade. Is this a good trade? Could there be reasons to question the GS advice? If you're gonna play the game, boy, you gotta learn to play it right. The questions --- and answers in Part 2 here tomorrow.

|

Note: This story is deeply intertwined with recent RBN posts about storage at Cushing (You’re Doin’ Fine Oklahoma!), the rising production of light crude from the Bakken (It Ain’t Heavy, It’s the Bakken) and the influx of Canadian Heavy crude south of the border (It’s a Bitumen ,Oil). |

-----------------------------------

"The Gambler" was written by Don Schlitz and recorded by Kenny Rogers in November 1978. It was one of five consecutive songs by Rogers to hit #1 on the Billboard country music charts, and won the Grammy award for best male country vocal performance in 1980. “…You got to know when to hold 'em, know when to fold 'em.”

Each business day RBN Energy posts a Blog or Markets entry covering some aspect of energy market behavior. Receive the morning RBN Energy email by simply providing your email address – click here. |