Contributor: Willis Bennett, ecomenergy.com. One of the more intriguing questions facing the industry this winter is what merchant operators [1] will do with the surplus storage volumes at the end of this withdrawal season, and how quickly the market will start purchasing next winter’s storage inventories.

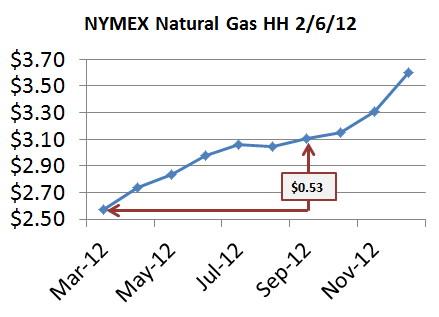

Do you sell into this weak cash market we have in March and hedge to next winter? In other words, dump your surplus now at ~$2.60 and buy back at current forward curve prices north of $3.00. Today there is a $0.53 differential Sept-March. (See graph below). Or do you hedge against the Aug-Dec contracts with a historically high spread (percentage calendar basis). That means - hold on to your inventory now but sell futures against the forward curve for the Aug-Dec timeframe.

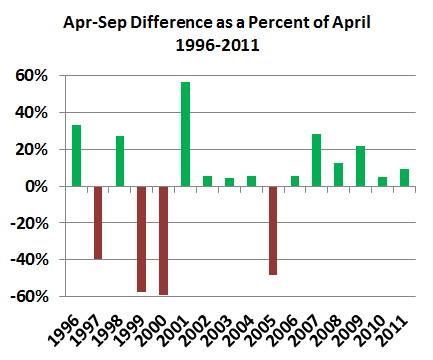

History shows us that merchant operators will start purchasing in April with the normal seasonal contango (April trading at a discount to September). However, the following chart clearly indicates that hurrying injections is not necessarily the most profitable strategy. The chart shows the April versus September spread as a percentage of April for each year since 1996. In only four of the last 16 years has September expired at a premium to April expiration and one of those was hurricane induced (2005). In fact, looking back ten years, 2005 is the only year that September was priced at a premium to April. Over the last six years the September discount has averaged 15 percent.

While the market is trading at a ten year low today, it does not necessarily mean that the lowest prices are now, or even over the next couple of months. Conventional wisdom expects merchant operators to start selling off excess inventories in March, with this adding to the already bearish direction of the cash markets. This would probably suck down the futures markets as well. There are many market participants expecting that to happen, and are laying in trading strategies in anticipation of a break below $2.00.

However, there is at least one other plausible scenario – Storage operators defer selling into today’s soft market and hold on to inventories until later. This would allow for storage levels to fill sooner in the injection season and move the downward price pressure later in the year, perhaps Q3. The weak Q3 scenario is the more likely outcome based upon the last decade’s history.

So if you are expecting a big selloff and further crash in natural gas prices, you may need to wait a few months. And if you need to buy storage inventories for next winter, take your time. Unless something goes crazy next fall, the market will come to you.

____________________________

[1] Here we use the term Merchant Operators to describe holders of natural gas storage volumes at risk of price fluctuations. LDCs and other utilities holding storage volumes to meet system needs may have a much different risk profile. Note that the operator of the storage facility itself may or may not be exposed to commodity risk for gas held in the facility.

____________________________

Note from Rusty – We could have called this “Do I stay or do I go” or “Hold on to what you’ve got” or any number of rock lyrics inspired titles. But I was getting in a rut and promised a moratorium on rock titles for at least a week.