As we move into Q2, the west has become wild (volatile) once again as the Pacific Northwest (PNW) hydro situation continues to see an overall increase in the snowpack levels and California has encountered several in state binding constraints. Since April 1st, SP15’s heavy load prices have increased by roughly 40% compared to the end of March while NP15 has remained unchanged (SP15 is the Southern California power trading hub while NP15 is the Northern California hub.) For background see my post from March 21st Under Water? Snowpack, Water Levels and Hydropower in the PNW. [Posted by contributor Jeff Richter]

Looking back at the end of March, the PNW saw below normal overnight temperatures and an abundant amount of precipitation in the region thus pushing the overall snowpack (hydro generation storage) levels higher.

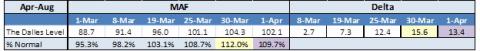

The table above illustrates just how big the increase was. The Dalles level increased by 15.6 MAF (million acre feet) from March 1st to March 30th. This put the water volume at roughly 112% of normal (see yellow highlighted cells). As of April 1st, the precipitation forecast has backed off slightly, thus bringing the overall MAF down to a delta of 13.4 MAF or 109.7% of normal (purple highlighted cells).

So what does all this mean to the system? First April flood control targets will ultimately drop the elevation levels at Grand Coulee to make room for the increase in snowpack. Currently its elevation is at 1,256 ft and will most likely have to get to around 1,222 ft by the end of April. Doing the math, that is roughly 1.2 ft per day, which is a lot of wood to chop over the next 28 days. Second, Bonneville (BPA) started to spill roughly 10 days early thus moving water around the generation turbines. This produces less megawatts as water goes around the generation turbines. This spill action superseded the mandatory spill that is scheduled to be in place the first 10 days of April (for fish purposes). Finally, the key to the increase in snowpack will boil down to a weather play: if it warms up the lower elevation snowpack will melt thus ‘flashing’ the Lower Snake River and increasing flows on the system. It will also cause the other side rivers to flow more as well thus putting pressure on the flood levels around Vancouver/Portland. To maintain flood control, system operators would have to hold back water at Grand Coulee.

Down in California, a constraint on the Socal Edison (SCE) system has been causing quite a stir in the marketplace. A power market rule (called the SCE Limit Constraint) requires that 40% of the load within the SCE Balancing Authority (BA) sub-region must be met by generation inside the region itself. Lately that rule has been a problem. Over the past two days the constraint has been kicking in, thus forcing the market to clear higher in the supply stack; thus SP15 prices cleared $37.69 in the heavy load hours and $20.56 in the light load hours. Northern California markets had little to no impact as NP15 came in at $23.16 and $17.25 respectively, thus putting the SP15-NP15 spreads at $14.52 and $3.30. That’s a huge spread. No wonder Socal Citygate gas prices are $0.45/MMbtu over Henry Hub.

So what is causing such a ruckus in the SCE thermal stack? The story begins a couple of months back when both San Onofre Nuclear Generating Station (SONGS) units went offline (January), removing over 2,000 mw of supply from the bottom of the stack. Below is a summary of the major events pertaining to the SONGS outage:

What happened?

- SONGS unit 2 went offline Jan 10th for scheduled refueling. Three weeks later, Jan 31st, SONGS unit 3 went offline in an emergency shut down due to a radiation leak into the containment dome caused by a partially ruptured tube.

- Testing revealed abnormal wearing in the recently installed steam generators (both units steam generators were replaced within the last three years), leading to approximately 200 tubes plugged in unit 2. During pressure testing on unit 3 multiple tubes failed leading to an augmented inspection team (AIT) being sent by the NRC to examine the reactor.

Where are we now?

- Both reactors remain offline and will do so indefinitely until the NRC criteria recently laid out for restart are met.

- The cause(s) of excessive wearing has not been established at this time nor has any plan for immediate restart filed for either unit.

- A report on the situation is being prepared and is scheduled for release 30 days from completion of an inspection (which began 3-19), with no fixed timeline given on the end date of inspections. The Chairman of the NRC and local congressional representative are planning to inspect the plant later this week.

What are the criteria for restarting the reactors?

- For unit 2, SCE will determine the cause of the tube-to-tube interactions that caused excessive tube wear in unit 3. SCE will ensure that the interactions observed in unit 3 will not occur in unit 2 before restarting the unit. Prior to restart SCE will submit a written assessment of the unit’s current status as well as a plan for inspections and operations going forward as well as assurances the unit will operate safely going forward.

- For unit 3, SCE will finish in-situ testing for tubes with significant wear indications and then plug tubes as required. SCE will then determine the causes of tube-to-tube interactions in unit 3. Prior to restart SCE will submit a written assessment of unit 3’s steam generator, operation protocol going forward, and the basis for believing the unit is capable of safe operation.

In the month of March, the SONGS outages have increased the overall heat rates roughly a full point and kept the Socal basis strong. Then on April 1st, things changed again as the SCE thermal stack got hit by a series of plant outages. And that triggered the 40% run-up in SP15 prices.

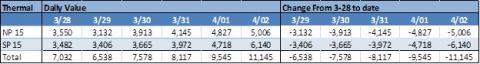

The table below breaks down the SP15 and NP15 thermal outages by region since Mar 28th. As you can see, the grid is shorter by 4,100 mw over the past week – a huge number. This has the effect of shifting up the overall energy cost on the grid along with the SCE Limit Constraint binding due to over 2,200 mw coming offline in SP15 (right in the heart of the SCE Limit).

The major SP15 units affecting the limit are Inland Empire (400 mw), Pastoria (790 mw), Blythe (493 mw), Sunrise (350 mw). Per the California Independent System Operator outage report all these units have reported offline along with Alamitos Unit 4 showing up as well adding another 336 mw to the mix. Redondo Units 6 and 8 showed offline while Unit 7 came back thus netting out to roughly 0. At the end of the day, the 2200 mw delta since the end of March was a tipping point for the SP15 gen hub as it had to climb higher in the supply stack to meet minimum generation requirements.

Pastoria and Inland Empire are expected to be back online starting tomorrow thus the 1200 mw should help bring the implied heat rates back down to some sensibility. But the handwriting is on the wall. The last couple of days have given us a sneak preview into what the summer might look like if both SONGS units remain offline and a few units trip, hence the Wild Wild West.

If you would like to discuss these topics or understand our Fundamental Analysis Product at Energy GPS, please email me at info@energygps.com or call 503-989-9540.

We’ve got something new on RBN starting last week. Check out Updata’s daily technical analysis for natural gas and crude markets here.

Each business day RBN Energy posts a Blog or Markets entry covering some aspect of energy market behavior. Receive the morning RBN Energy email by simply providing your email address – click here. |