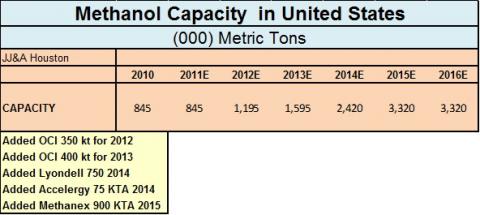

Contributor: Jim Jordan, Jim Jordan and Associates. We recently took a look at the future methanol supply situation for the United States. Methanol is making a comeback in the US due to less expensive natural gas. The table below provides a view of methanol capacity in the US, assuming that the announced restarts take place as scheduled. This assumes that the OCI plant starts up mid-2012, the LyondellBasell plant restarts at the end of 2013, the relocated plant from Wyoming is restarted by Accelergy at the end of 2013 and Methanex’s relocation of a Chile plant is completed by the end of 2014.

As can be seen from the table, methanol capacity was 845 KTA going into the year 2012. Prior to a host of plant closures beginning in 1999, US methanol capacity exceeded 7 million metric tons. By adding the plants listed (as indicated in the table), capacity grows to 3,320,000 metric tons per year by 2015.

Based on the capacity table, we can assume that capacity will grow by 2,475,000 metric tons by 2015. A typical methanol plant will convert natural gas to methanol at about 34 million BTU’s per metric ton. Some are more efficient, some less. While not significant on a macro-scale, these restarted methanol plants will add a considerable new demand for natural gas in the US Gulf Coast.

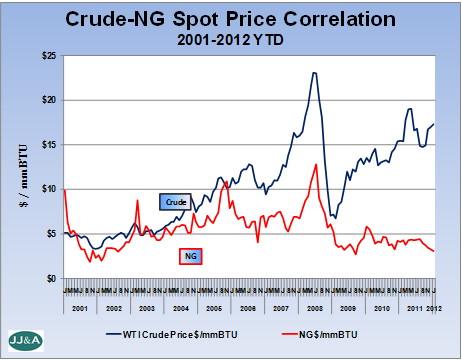

One consideration for these re-starts is the longer-term outlook for natural gas. The following graph tracks WTI crude and Henry Hub natural gas from 2001 on a $/MMBTU basis. As the graph illustrates, the two began separating in value around 2006 when crude values began moving up and gas down. The separation of the two became much more pronounced in 2009 and is currently about as wide as it has ever been.

The question here becomes, will this separation continue? Many believe it will. JJ&A is not expert on energy, but while we agree separation is likely to last for a number of years, we doubt seriously if the spread that we see today can last long term. This doesn’t necessarily mean natural gas prices will go up, as crude could come down.

However, demand for crude is global and demand for US natural gas is regional unless we start exporting LNG in a big way. We believe the more likely scenario is that wells will be shut in to reduce natural gas availability in order to get some price recovery. How soon and how much is obviously subject to a lot of speculation, but in any event, we do not believe that natural gas prices will remain in the $2.50/MMBTU range for an extended period.