“As benchmark gas futures plummet to their lowest level in nearly a decade, analysts are considering the prospect that prices could actually turn negative as utilities and traders scramble to sell off surplus gas supplies held in storage caverns to avoid hefty contractual fines.” This is from a Reuters article on Friday titled “U.S. natural gas: so much they'll be giving it away”.

Could such a thing really happen? It certainly did a few years ago in the Rockies. In 2007, spot natural gas in the Rockies went for $.01-$.05 (yes, a penny to a nickel) for a few days due to rising production and severe capacity constraints on outbound pipes.

Here are a few more quotes that help set the historical perspective.

A Bleak Season for Natural Gas. The spot market fell again yesterday. The futures market for natural gas (has).. just about written off the winter. Two years ago, many analysts and producers figured that the end was near for a period of gas oversupply….The dominant view (today) is that gas prices are likely to remain depressed. Timothy J. Curro, energy analyst at UBS Securities in New York, said, "I don't think a very strong case can be made for the price of natural gas for the next three or four years." Ronald J. Barone, a managing director and analyst at Kidder, Peabody in New York, said, "This is the worst year for gas prices in a long, long time." …Big inventories remained in pipelines and storage tanks this fall after one of the warmest winters of the century last year.

Now the perspective. Those quotes were from a 1991 New York Times article!

One advantage of being around this business for a long time is that there is not much that we haven’t seen before. And gas gluts (formerly called bubbles, BTW) have been a fixture of this business since time immemorial.

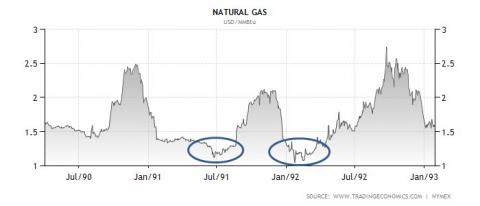

I was responsible for gas sales in 1991 at Texaco. About 2.5 bcf/d of the company’s production sold mostly during bidweek, but some moved on the spot. (Those were days before electronic trading and highly liquid daily markets, when NYMEX was just getting started.) Here’s what I remember about that period of massive oversupply during the summers of 1991 and 1992. Prices dropped hard from the $2.50s in the winter 90-91 down to $1.40 in the shoulder months. Then got whacked hard in the summer down to $1.10 or so. It got back over $2.00 in the winter of 91-92 before falling to $1.05 in January of 1992. Futures are in the chart below. Cash prices were trading in the mid-80 cent range.

What did we learn from the Rockies experience five years ago, and the overall market collapse of 20 years ago?

The Rockies experience showed that prices can fall to pennies, at least in the daily market. But this was in a localized market with severe transportation capacity constraints. There really was no place to go with the gas. So anyone who had to move their gas or face the prospect of reservoir damage, huge pipeline imbalance charges, or other onerous outcome had to take any price offered to make sure their gas would move. Since all the pipes were full, that dynamic created a scramble to the bottom for Rockies producers. And the result was virtually free gas. But that situation simply does not apply to the market as a whole. The Rockies had a finite number of outlets, and they were all maxed out. The market across North America has hundreds of adjustment mechanisms that can make gas go away for short periods of time. More about that below.

- In 91-92 it was not a local problem. Gas was long everywhere. On some days, in certain parts of the country, not a single buyer could be found. T&E reps (gas transportation specialists) worked overtime to move gas to places where it could be sold. Still, the price did not fall to zero. All sorts of market niches kicked in that kept prices above $0.75.

- The same thing will happen in 2012. More gas will replace coal in power generation. Dry gas drilling will grind to a halt. Producers will freeze dry gas well completions. Pipes will use linefill for additional storage capacity. Some producers may actually shut in ((though not much, as noted here before). Ratchet storage deals (must-take storage contracts Reuters cites as the possible trigger for negative prices) will get re-negotiated and tweaked. And don’t forget. There is lots of storage capacity out there. That won’t get tight again until the fall.

- These and other factors that fly beneath the radar of energy statistics will reach out and surprise us. The Rockies experience of 2007 will not be repeated at Henry Hub in 2012. And who knows, a blast of late season cold weather could always take a little of the edge off.

- Is all this to say that gas prices won’t be going lower? Not hardly. It seems to be generally accepted that $2 is coming, and that could make it almost a self-fulfilling prophecy. In fact, watch out for bidweek numbers coming up this week.

- But the bottom is not free. In fact, if you’ve got some free gas give me a call and I’ll take it off your hands.

* From the Dire Straits song