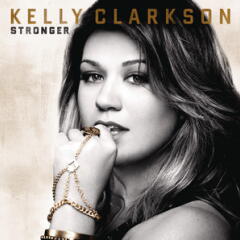

Stronger – Midstream M&A Slows as Companies Focus on Buying and Selling Specific Assets

There’s been a lull in midstream M&A activity the past few months, but several companies in that space have been making significant adjustments to their portfolios, either by acquiring assets from others or selling ownership interests in their own businesses.