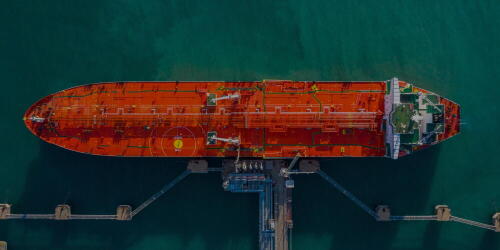

Where She Goes – For Gulf Coast Refined Products, It’s Down to Mexico by Truck, Rail, Ship and Pipe

U.S. exports of gasoline, diesel and jet fuel to Mexico have been mostly rising the past 15 years.

RBN’s Daily Energy Blog and Insights sharpen your energy IQ through fundamentals-based analysis that makes sense of North America’s energy market dynamics.

U.S. exports of gasoline, diesel and jet fuel to Mexico have been mostly rising the past 15 years.

Houston and Corpus Christi dominate crude oil exports, but the balance between the two hot spots has been shifting in interesting ways recently.

The Crude Voyager is a weekly analysis of U.S. Gulf Coast loading activity that explains the ebbs and flows of crude loadings, destinations, and geopolitical issues impacting U.S. exports. It outlines the major paths for laden tankers hauling U.S. crude all over the world and reflects the change in tanker departures to the main regions that consume U.S. crude.

U.S. oil and gas rig count edged down one rig to 550 for the week ending February 27 according to Baker Hughes data, as a two-rig decline in the Gulf of Mexico more than offset a one-rig gain in the Permian; all other basins were unchanged.

All 40 electrolyzers at the ACES Delta storage hub in Utah have been installed and have operated at 100% load, HydrogenPro, the site’s electrolyzer supplier, said during its Q4 2025 earnings call on February 27.

For E&Ps, differences in financial performance often stem from accounting methodology, specifically from whether a company uses the Full Cost (FC) or Successful Efforts (SE) method to account for its oil and gas properties.

Cheniere discussed the timeline of the Stage 3 project at Corpus Christi and the Midscale Trains 8 and 9 during its earnings report this week.

Canadian crude oil production has reached highs and is expected to continue growing.

The Natural Gas Master Class was a one-day online event focusing on understanding flow analysis, interpreting pipeline data and forecasting future flows. This course is designed to equip you with the knowledge and skills to effectively analyze the complexities of natural gas markets, flow analysis, and pipeline modeling. Watch the replay today!

The fundamentals of the natural gas market have never been better, but the continued buildout of midstream infrastructure remains critical to meeting supply-and-demand needs in the coming years, a trio of industry experts said during a panel discussion Wednesday at RBN’s GasCon 2026 conference in

Two giant natural gas producers and an analytics expert are hopeful natural gas will remain available to meet growing demand, but logistical and infrastructure challenges will shape how smoothly they can get it to market.

U.S. propane inventories edged lower, but PADD 3 remains heavily oversupplied as PADD 1 inventories fall to multi-year lows. The widening regional gap continues to shape the market narrative.