You're the Ones That I Want - DOE Is on Its Way to Selecting Hydrogen Hub 'Winners'

If clean hydrogen is not a significant contributor to the U.S. energy mix by the 2030s, it won’t be because Congress and the Biden administration didn’t try.

RBN’s Daily Energy Blog and Insights sharpen your energy IQ through fundamentals-based analysis that makes sense of North America’s energy market dynamics.

If clean hydrogen is not a significant contributor to the U.S. energy mix by the 2030s, it won’t be because Congress and the Biden administration didn’t try.

Thanks to a warm start to the season and low Asian demand for LNG, Europe has so far been able to stave off a worst-case scenario for natural gas supply this winter.

Natural gas pipeline project permitting sits at the nexus of the debate about the best path toward decarbonization. Industry proponents rightly point out that pipelines can reduce aggregate emissions by displacing much higher burner-tip emissions from coal in power generation.

It could be argued that no sector in the energy industry has seen more uncertainty the past three years than refining.

Last week, even as natural gas day-ahead prices went negative in the Permian’s Waha Hub in West Texas, spot prices at northern California’s PG&E Citygate last week traded at a record-smashing $55/MMBtu, according to the NGI Daily Gas Price Index — close to 100x the Waha price.

Winter arrived early in many parts of the U.S. this year, with frigid temperatures and, in some places, snow measured in feet, not inches. Propane demand for heating is up, but surprisingly, inventories are high, prices are low and the outlook for the rest of the winter looks good.

Shipping Alberta’s fast-rising bitumen production to market through pipelines or on insulated rail cars depends on sufficient supplies of diluent, a variety of light hydrocarbons that, when blended with molasses-like bitumen, reduce the viscosity of the resulting mix.

A potentially important factor affecting the supply of octane — the primary yardstick of gasoline quality and price — has been lurking in the background over the last few years.

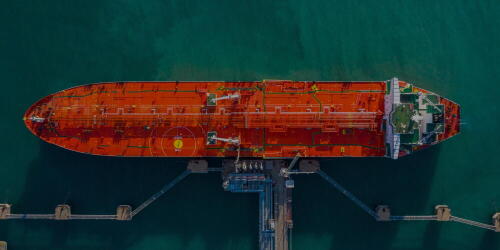

The Crude Voyager is a weekly analysis of U.S. Gulf Coast loading activity that explains the ebbs and flows of crude loadings, destinations, and geopolitical issues impacting U.S. exports. It outlines the major paths for laden tankers hauling U.S. crude all over the world and reflects the change in tanker departures to the main regions that consume U.S. crude.

Storm clouds may be gathering on the economic horizon as concerns about persistent inflation and looming recession roil markets and politics.

Over the past nine months, the frac spread —a rough-cut measure of the value of extracting NGLs from raw gas at gas processing plants — has taken a terrifying plunge, from $9.82/MMBtu in early March to only $2.16/MMBtu on Monday.