We Did Start the Fire—Gas Pipelines’ Role in Reducing Bakken Flaring

From space the light thrown off by Bakken gas flaring makes sparsely populated western North Dakota look like Minneapolis-St. Paul.

RBN’s Daily Energy Blog and Insights sharpen your energy IQ through fundamentals-based analysis that makes sense of North America’s energy market dynamics.

From space the light thrown off by Bakken gas flaring makes sparsely populated western North Dakota look like Minneapolis-St. Paul.

Yesterday (April 30, 2014) the Energy Information Administration (EIA) reported yet another increase in Gulf Coast inventories as of April 25 - adding 5.7 MMBbl to set a new record of over 215 MMBbl of crude.

Permian Basin crude producers are currently churning out over 1.5 MMb/d of crude from a basin that has produced oil since the 1920’s but is the center of a recent renaissance.

The success of an LNG export project is founded on many things. Good connections to natural gas supply. Easy access to LNG buyers. A competitive delivered cost. Timing matters too, and may turn out to be a critical factor for Veresen’s Jordan Cove LNG export project in Oregon.

Last week Transport Canada (the federal department responsible for transportation policy) directed that DOT-111 rail tank cars built prior to new safety standards proposed in January 2014 be phased out or refitted within three years.

The next six months look set to be quite turbulent for Permian Basin producers. Crude production is now over 1.5 MMb/d and supplies trying to get to market are facing congested pipelines leading to price discounts.

From the start of the Bakken oil production boom four years ago, a substantial portion of the associated natural gas produced has been flared, mostly due to a lack of gas gathering and processing infrastructure.

Exports of liquefied petroleum gases (LPGs – propane and butane) from the U.S. to international markets - are expected to nearly double from 460 Mb/d in 2014 to 915 Mb/d in 2019 as production from gas plant processing exceeds domestic demand.

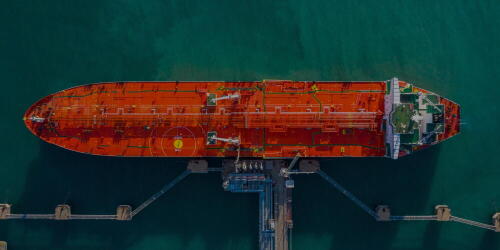

The Crude Voyager is a weekly analysis of U.S. Gulf Coast loading activity that explains the ebbs and flows of crude loadings, destinations, and geopolitical issues impacting U.S. exports. It outlines the major paths for laden tankers hauling U.S. crude all over the world and reflects the change in tanker departures to the main regions that consume U.S. crude.

Despite the challenges they would likely face, as many as four companies are exploring the possibility of exporting liquefied natural gas (LNG) from the Canadian Maritimes [1] to Europe, Latin America and Asia.

With the Keystone Pipeline decision booted down the road again Friday, the challenge for Canadian oil sands producers trying to get their crude to market looms large once again. Growing volumes of Canadian crude will be carried by rail this year to bypass pipeline congestion.