Knocking on Heaven’s Door – The Eagle Ford Crude Story Part II

<p>Eagle Ford crude production is close to 600 MB/d. Midstream infrastructure projects are springing up left, right and center to deliver this production to refineries.</p>

RBN’s Daily Energy Blog and Insights sharpen your energy IQ through fundamentals-based analysis that makes sense of North America’s energy market dynamics.

<p>Eagle Ford crude production is close to 600 MB/d. Midstream infrastructure projects are springing up left, right and center to deliver this production to refineries.</p>

Ethanol from corn as a motor gasoline blend stock seems like a good idea. As an oxygenate it is supposed to clean up the air, and as a U.S grown renewable it reduces our dependence on fossil fuels and foreign oil. The catch is that ethanol is being mandated under a morass of mind-numb

After NYMEX WTI climbed higher all last week, topping $90/Bbl, euro-zone worries yesterday caused a 4 percent fall in crude to close at $88.14/Bbl. That is a still a long way above estimates of $50/Bbl break-even prices for crude produced from Eagle Ford shale.

August natural gas closed on Friday at $3.08/MMbtu, up 8.2 cnts and above $3.00 for the first time since January 9th 2012. Crude oil was down $1.22 to $91.44/bbl. That puts the gas to crude oil ratio at 30X, about half the 54X milestone hit in April and celebrated here in the series

King Coal is hurting. NYMEX Central Appalachian Coal prices have fallen 18 percent so far this year from $68.67/ short ton (ST) on January 3, 2012 to $57.23/ST on Monday (July 16, 2012). Coal consumption is down and coal company profits are hurting. Patriot Coal filed for bankruptcy last Monday.

A week or so ago in Part IV of the Marcellus Changes Everything series, we noted that by 2016 there would be a summer surplus of natural gas production from the Marcellus of around 3 Bcf/d.

Three years ago the predicted onslaught of Marcellus NGL production kicked off a horse race to build new ethane pipelines out of the region. At one time, at least seven different projects were being promoted.

Just when we thought that East Coast refining had become an oil company’s equivalent of musical chairs and all the players were headed for the exits, a consortium including Carlyle, original owners Sunoco, and JP Morgan strung together a deal to save the 330MB/d Philadelphia refinery that had bee

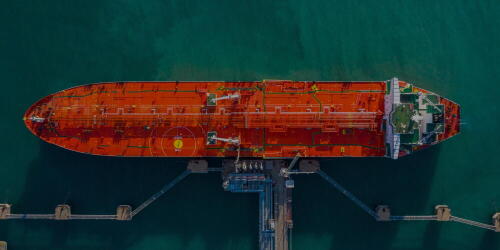

The Crude Voyager is a weekly analysis of U.S. Gulf Coast loading activity that explains the ebbs and flows of crude loadings, destinations, and geopolitical issues impacting U.S. exports. It outlines the major paths for laden tankers hauling U.S. crude all over the world and reflects the change in tanker departures to the main regions that consume U.S. crude.

Today the Energy Information Administration (EIA) publishes weekly US natural gas storage numbers for the week ending July 6, 2012. Last week EIA reported 39 Bcf injections making the total storage 3,102 Bcf.

So far this year WTI crude prices have fallen 22 percent from their highs in February 2012 to close at $85.99 /Bbl yesterday (Monday). Brent crude prices fell 21 percent over the same period to close at $99.73 /Bbl yesterday. WTI has traded at an average discount to Brent of $15 /Bbl this year.